Bitcoin Technology and Use Cases

| ✅ Paper Type: Free Essay | ✅ Subject: Technology |

| ✅ Wordcount: 1551 words | ✅ Published: 24 Nov 2017 |

Contents

What steps are required to accept bitcoin?

Payment flow summary (merchant service):

Introduction to Bitcoin

Unlike traditional ‘hard’ cash, Bitcoin[1] is not a physical entity. Rather, the term refers to a peer to peer computer network that allows bitcoins (BTC’s) to be transferred from one ‘digital wallet’ to another. The Bitcoin is not under the control of any one financial institution (decentralised) which results in it being less susceptible to changes national monetary policy. This does not mean however, that the value of the bitcoin will not change in relation to other fiat currencies.

A defining feature of the Bitcoin network is that mathematical encryption techniques allow the proof of ownership (and transfer) of bitcoins without the services of a third party, for instance, a bank or credit card company. A significant advantage of the direct A to B transaction is the associated reduction in fees.

As bitcoins are essentially files existing within the Bitcoin network, they are not printed or minted. The process of generating bitcoins is performed by individuals or groups who effectively maintain transaction integrity within the Bitcoin network by undertaking a computationally intensive process termed ‘mining’. Each time a miner solves the complex mathematical code required to complete the transaction they are rewarded with 25 bitcoins and new BTC’s are added to those already in circulation.

What steps are required to accept bitcoin?

As the business operates direct retail sales in addition to providing an online order and collect service, these two operating implementations will be considered independently.

Point of sale

Whilst it is entirely possible to implement a small scale POS solution to accept bitcoin transactions directly without a merchant service, these systems are manually intensive and do not lend themselves well to the retail environment.

A solution that lends itself better to the retail environment is that of using a merchant service to process the transaction from customer to receiving payment. In general, POS bitcoin solutions fall into one of two hardware technologies; those which utilise a dedicated terminal, similar to the type used for POS credit card transactions, and those that use a PC, smartphone or tablet computer for the customer interface. Irrespective of which hardware technology is used, the payment flow is similar for each – Figure 1.

Payment flow summary (merchant service):

1 –Assistant enters amount of purchase entered as GBP into retail interface (PC, tablet, smartphone or terminal). Request button pressed.

2 – Merchant system responds by generating QR code for the café’s bitcoin digital wallet address, in addition to applying the GBP to BTC conversion rate.

3 – Customer uses a bitcoin client installed on their smartphone/tablet to scan the displayed QR code and confirms payment. Note: Near Field Communication capability could replace QR scan

4 /5 – Business and customer receive confirmation of payment

Web sales

Implementation of a bitcoin supported payment system will require the services of the businesses’ web developer. In reality, the amount of work required to integrate a ‘Pay by bitcoin’ button into exiting payment webpages (including shopping cart platforms) is relatively small, as vendors of bitcoin merchant services provide the required ‘code’ or ‘plugin’ to the web developer free of charge.

Potential benefits

Although the future of Bitcoin is uncertain, it is evident that this trading platform continues to receive attention from the media, investors and the public. Whilst implementing Bitcoin facilities in the café and on the website are unlikely to transform the business overnight, it has the potential to attract new custom. Whether this is through novelty, curiosity or purchasing preference is largely irrelevant, providing choice is the key. Furthermore, and perhaps more significantly, it has the benefit of putting the business ‘ahead of the curve’ in relation to the majority of competitive businesses. If Bitcoin really moves into the mainstream, the business will be ready to move with it and reap the benefits accordingly. Financial benefits are also evident. Firstly, there is there a dramatic reduction in transaction fees compared to credit card and third party supported transactions (zero percent in some instances), and secondly, there is no VAT on Bitcoin transactions (http://www.hmrc.gov.uk). These savings could, in whole or part, be passed on to customers to encourage Bitcoin use.

From the customers perspective the primary benefit is that paying by Bitcoin obviates the need to carry cash or card. Additionally, web transactions can be completed without having to enter card details.

Potential drawbacks

For the business the drawbacks of implementation are minimal. Staff will need to be trained in carrying out the transactions, and there will be fees associated with web implementation. Beyond this there is minimal risk to the business; in reality risk is biased toward the consumer. Using a merchant and electing to ‘cash out’ Bitcoin transactions to a GBP account limits exposure of the business from bitcoin volatility, potential hacking (theft) or complete collapse of the currency. The consumer however, is potentially exposed to all these risks. A potential drawback for both parties is transaction confirmation time which, if normal Bitcoin rules are applied, can take 10 minutes to complete. The only way to overcome this is for the business to accept zero confirmations on the transaction.

A way forward

Given that provision of a Bitcoin facility in the café can be achieved with minimal risk and investment, it is suggested that the facility is implemented as soon as possible. Further research will be required to find the most cost effective merchant service, and hardware will need to be sourced for the transaction terminal (PC, tablet or smartphone). Customers need to be informed of the service, so ‘Bitcoin accepted here’ signs should be printed or purchased. With a facility operational in the café uptake and public option can be monitored and an informed judgement can be made on whether to invest in a Bitcoin solution for the website.

Bibliography

http://www.hmrc.gov.uk/briefs/vat/brief0914.htm

Appendix 1 – Technical Detail

The underlying mechanism that preserves the transaction integrity of the Bitcoin network is that of Public Key Cryptography. This encryption method is based around the notion of a public key that anonymously provides a numerical identity to an individual, and a private key that is known only to the individual (a signature). When these two keys are combined, the identity of the individual can be verified by another individual. Consider an example where ‘Alice’ wants to send bitcoins to ‘Bob’. To achieve this Alice uses her Bitcoin client to construct a message that details the transaction. By applying a hash function (i.e., SHA-256), Alice’s message is converted into a ‘digest’ that is a fixed length mathematical representation of the message. Using Bob’s public key, Alice encrypts the message and appends this with the digest which she has encrypted with her private key. This message is then sent to all nodes on the Bitcoin network. As Bob is part of the network he will receive the message and only he can use his private key to decode it, and Alice’s public key to decode the digest and check that it is valid.

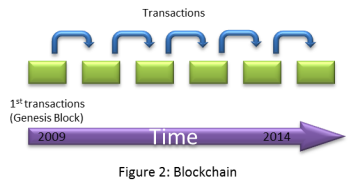

Although robust, the above method of transaction has no protection against Alice double spending her available bitcoin balance by sending similar messages to other recipients. This is controlled by the use of a public transaction ledger termed the ‘blockchain’, which contains records of every transaction that has ever occurred on the network. As the name implies the blockchain is made up of ‘blocks’, each block incorporating the transaction records from the previous block, and so on – Figure 2. As each bitcoin is unique by decoding the most recent block it can be established whether there has been an attempt to double spend.

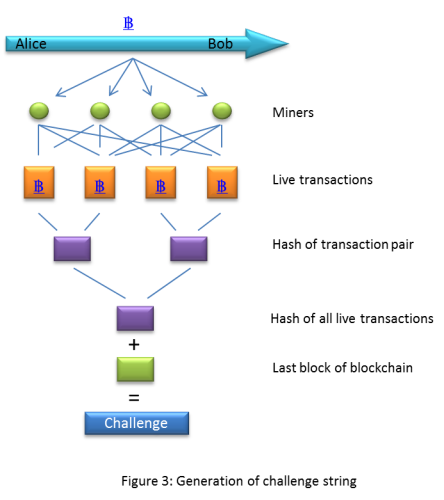

The final consideration is how new blocks are added; this is achieved by the significant computational effort of special users on the network (bitcoin miners) who validate transactions by producing a proof-of-work. Achieved as follows: at any given moment in time there will be numerous transactions on the network in addition that of Alice and Bob. Miners will take each pair of transactions and apply a hash function to produce a digest of the pair. This is repeated until they have a digest of all ‘live’ transactions – Figure 3.

This digest is then combined with the last block in the blockchain which is converted into a challenge string. The miner then uses significant CPU power to generate a proof string that when combined with the challenge string and applied as the input to a cryptographic hash function produces an output with a very specific characteristic. Namely, that the output number has to contain a specific number of leading zero’s as defined by the Bitcoin protocol. If the correct proof is found, the miner adds the block to the blockchain and the process repeats for new transaction sets. As the complexity of finding the correct proof string increases with the number of leading zero’s, Bitcoin protocols use this to ensure that the average completion time of a block is 10 minutes.

[1] The reader should note the use of Bitcoin (with a capital B) to denote ‘the network’ as opposed to bitcoin (with a lowercase ‘b’) that denotes the units of the network, referred to as BTC.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal